A tax whose time has come

Writer: Sriwipa Siripunyawit

Among all reforms, a tax restructure is high on the military regime's agenda and has grabbed the public's attention because it affects practically everyone.

According to the revised draft of the land and buildings tax in September 2012, agricultural land would be taxed at up to 0.1%. PEERAWAT JARIYASOMBAT

A land and buildings tax is believed to be on the urgent list. This tax is nothing new, having been proposed and discussed over the past 20 years by government after government —

but nothing has taken shape. Why not?

The Abhisit Vejjajiva government did more than most on the issue. Korn Chatikavanij, a deputy party leader and finance minister at the time, bravely took the lead by completing a

draft amid opposition from many politicians, even within his own Democrat Party.

The draft eventually passed cabinet muster and made it to parliament, but just before the House was dissolved in 2011. Later the draft was permanently killed by the Yingluck Shinawatra government, which cited problems with the law's structure.

The reasons are vivid. From a political standpoint, governments and MPs are wary of losing their popularity since the tax is seen as a new financial burden for owners of land and homes, large and small. The tax would also shake up the benefits and interests of affluent politicians who have ample land and property in their possession.

"Conflict of interest is a clear explanation," says Asst Prof Duangmanee Laovakul of Thammasat University, who sat on a subcommittee that drafted the law in 2007. "We can see that MPs or those having power in pushing this law forward are the same persons as those possessing a vast amount of land and property."

Kitipong Urapeepatanapong, chairman and head of the tax practice group at Baker & McKenzie, notes that the law has a decent rationale behind it despite always having been scrapped.

"Most politicians fear losing their power base and benefits, so it has never been pushed forward," says Mr Kitipong, also chairman of the tax committee at the Thai Chamber of Commerce.

The question is whether the draft will be pushed further and put in to practice during the junta's administration.

"In the beginning the National Council for Peace and Order (NCPO) seemed to have a strong will to push this law forward, but now I'm doubtful about its determination," Mr Korn says.

"As a military government, it should drive difficult agendas that normal governments under normal circumstances cannot achieve, be it this land and buildings tax, the value-added tax or energy price reform. These are urgent issues that must be done.

"One thing I believe is if it's the right thing, then there won't be any negative results and people will understand in the end."

"It'stime to have this law," echoes Pongtip Samranjit, executive director of the non-profit Local Action Links. "This law will help the grass roots and small farmers out of poverty and reduce income disparity. We should not let down the agricultural sector like this. So it's the NCPO's duty to implement this law."

A Finance Ministry source says the land and buildings tax is part of recent reforms proposed to the NCPO for consideration. It is expected to move along to the National Legislative Assembly.

"This tax is something that must be done," the source says.

From income-based to asset-based tax

For more than two decades, tax authorities have attempted to shift their focus from an income-based to an asset-based tax. Mr Korn says the main reason is that income alone does not wholly reflect the wealth of taxpayers, especially those who own land and property.

"A taxpayer who has taxable income may not be the same person as someone owning large amounts of land and property. So the income-based tax might not be fair for the average hard-working employee," he explains.

The land and buildings draft proposed by the Fiscal Policy Office in September 2012 would set a maximum 2% tax on appraised value of property used for commercial purposes, up to 0.1% on residences and up to 0.1% on land used for agricultural purposes. Unused land would be taxed at up to 2%.

Those rates were adjusted upwards from a previous proposal. The new tax is aimed at replacing the existing house and land tax and local development tax, which are considered less efficient.

Narrowing income disparity

The new law is viewed as an instrument for reducing economic disparity, based on the belief that the rich have a greater opportunity than the poor in terms of income and ability to acquire assets and benefit from such investments.

Under the new law, owners of land and property including unused land would be taxed accordingly and the revenue used to develop the country as a whole. It would also permit local administrations to assess and collect tax to be returned for local development and necessary utilities. This would reduce the burden of the central fiscal budget.

The law would broaden the tax base. Mr Kitipong says that of the 55 million people in the workforce, 12 million pay withholding tax but only 2 million pay additional tax each year.

According to Mr Korn, it was earlier estimated that revenue from the new tax would stand at 25 billion baht in the first year, replacing the amount of revenue from two existing taxes that would then be terminated. Revenue is projected to increase each year with annual hikes in property value. This is one of the main advantages of the tax — assessing value and the use of land and property rather than income generated from them.

Reducing speculation and redistributing land

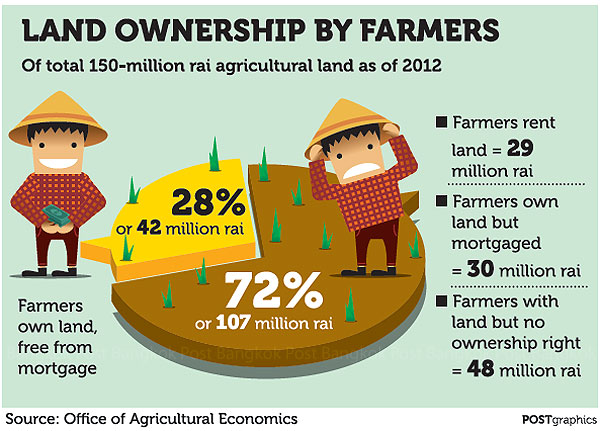

Asst Prof Duangmanee says a vast amount of land is possessed by the wealthy, and an increasing number of poor people find it harder to acquire land.

From her studies, the country's biggest landowners or 10% of the total own about 60% of the land, while the remaining 90% own less than 40%.

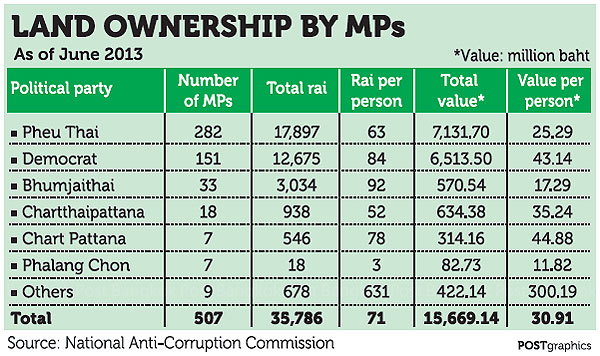

According to the National Anti-Corruption Commission, in June 2013 a total of 282 Pheu Thai MPs owned 17.9 billion rai of land, while 151 Democrat MPs owned 12.7 billion rai.

One objective of the new tax is to create costs for landowners, particularly large landholders. The idea is the tax will reduce the amount of land held by the wealthy, or at least compel them to make use of it.

To offset the higher cost of landholding, owners would be indirectly pushed to make use of their land through rentals that would create income, jobs and other economic value in return.

"So the new tax is likely to discourage large landholdings, particularly for price-speculation purposes, and gradually make better land distribution possible," says Asst Prof Duangmanee.

Based on a recent Treasury Department survey of 75 provinces, land prices on average rose by 5.34% a year, while in Bangkok the figure was 4.28%. But the price of land near infrastructure development projects normally jumps by two- or three-fold in a short period.

Suggestions

Since the law involves a large number of taxpayers, it is necessary to hear their opinion, Mr Kitipong says.

"The government needs to tell taxpayers how the collected tax revenue will

be spent. I believe the private sector is

willing to cooperate if everything is

transparent," he says, adding that tax policies must be clear in order to prevent the use of personal discretion by government officials.

Some say the proposed tax rates are too low, particularly if the goal is to reduce land price speculation. "In developed countries such as Japan, South Korea and Taiwan, the property tax rates are in the range of 3-5%," Ms Pongtip says.

Mr Kitipong shares similar concerns, saying the rates should be progressive and policies should incorporate city planning law. He further suggests the tax assessment be done centrally rather than locally: "I'm not sure if local administrations are ready for this matter."

On top of that, he says the IT and database system must be entirely improved in order to broaden the tax base, prevent tax avoidance and make tax collection more efficient.

มูลนิธิชีวิตไท (Local Act)

129/250 หมู่บ้านเพอร์เฟคเพลส รัตนาธิเบศร์ ถนนไทรม้า ต.บางรักน้อย อ.เมือง จ.นนทบุรี 11000

โทรศัพท์: 02 040 9969 | 090 178 7508

E-mail : This email address is being protected from spambots. You need JavaScript enabled to view it.